Methodological Approach

Ziraat Katılım conducted its materiality analysis for the first time in 2023, taking into account the Bank’s short-, medium-, and long-term strategy, Strategy Plan 2022-2025, and business model, as well as the developments during the reporting period. The materiality analysis was renewed in 2024 in line with current assessments and developments. The material topics, which are the outputs of the stakeholder analysis, form the basis of the Ziraat Katılım 2024 Integrated Annual Report.

With the materiality analysis, it was aimed to create an inclusive and up-to-date list of topics. In the process of identifying material topics, the main trends in the national and international banking and finance sector, global megatrends, and innovations in sustainability reporting frameworks were examined in detail.

The Bank’s senior management and the managers of units with strategic importance met to compile the opinions on substantial goals and future strategies and to reflect them in the analysis.

The materiality of the topics for stakeholders and the extent to which the relevant topic would be material for the Bank were assessed within the context of the materiality analysis. Additionally, during the reporting period, suggestions, appreciations, and complaints submitted to the Bank through various channels by customers, employees, and other stakeholders were analyzed, compiled, and included as input in the materiality study.

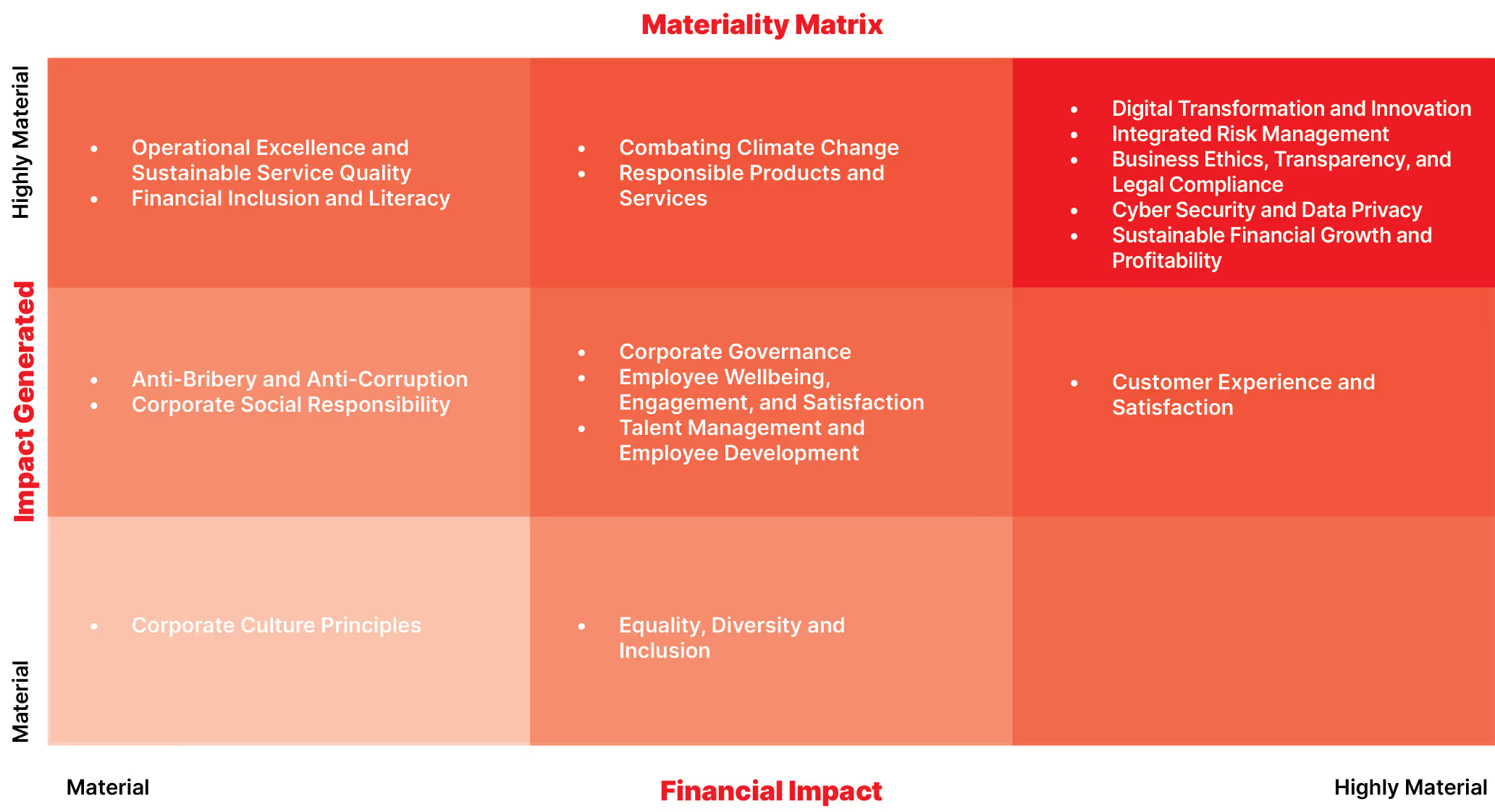

As a result of all these evaluations, Ziraat Katılım has successfully developed a materiality matrix that focuses on sustainability and ESG axes. The Bank will continue to update the materiality study as needed, taking into account developments within the framework of its operations.

Material topics that have a very high impact on stakeholders and Ziraat Katılım’s performance

Digital Transformation and Innovation

Ziraat Katılım focuses on strengthening its digital product offering competencies and technological infrastructure in this process where artificial intelligence is increasingly involved in the business and daily life cycle. To this end, the Bank designs end-to-end digital processes, increases the accessibility of financial products, and aims to increase its competitiveness by positioning its products and services in various channels.

Control Mechanism

The material topics are monitored by the Ziraat Katılım Strategy Committee and the Information Systems Steering Committee at certain intervals.

Integrated Risk Management

Ziraat Katılım considers global and local macroeconomic conditions and strives to manage financial and non-financial risks in an effective and holistic manner, taking into account the existing regulatory framework in Türkiye in terms of risk management. The Bank aims to play an active role in managing climate-related risks and opportunities. In addition, risks arising from natural disasters such as earthquakes, which are not directly related to climate change, are also included in the Bank’s Integrated Risk Management process. In this way, the Bank adopts a management approach that is sensitive to environmental risks.

Control Mechanism

The material topic is overseen by the Internal Systems Group Presidency, affiliated with the Audit Committee at Ziraat Katılım.

Business Ethics, Transparency, and Legal Compliance

Ziraat Katılım focuses on knowing its customers (Know Your Customer-KYC) and developing relationships within the framework of the rules stipulated by law and ethical standards. The Bank prioritizes the safety, security, and legal compliance of customer transactions and considers the prevention of financial and economic crimes (money laundering, the financing of terrorism, bribery, and corruption) as its duty.

Control Mechanism

The material topic is overseen by the Internal Systems Group Presidency, affiliated with the Audit Committee at Ziraat Katılım.

Cyber Security and Data Privacy

Ziraat Katılım strives to have the highest standards of cyber security infrastructure in the sector by focusing on endeavors to identify emerging risks and continuously improve system security in order to protect the confidentiality and security of customer and Bank data. This approach is shaped with an integrated information security management strategy that includes the implementation of advanced and multi-layered defense systems, supported by comprehensive security policies and standards, as well as a strong security awareness and training program.

Control Mechanism

At Ziraat Katılım, activities related to information security are carried out by the Information Security Unit, which reports to the General Manager. The processes are subject to audits conducted by the Internal Systems Group Presidency and Banking Regulation and Supervision Agency (BRSA). Also, the relevant processes are subject to ISO 27001 audits.

Sustainable Financial Growth and Profitability

The financially sound, sustainable, resilient, and competitive performance of Ziraat Katılım, which operates in accordance with the principles of participation banking, is of great importance not only for corporate sustainability but also for contributing to the development of the Turkish economy and the welfare of its stakeholders. The Bank’s financial performance and profitability are also critical and indispensable for the successful implementation of the strategic goals and projects set in the sustainability and ESG axes.

Control Mechanism

The activities carried out in coordination with all units of Ziraat Katılım are periodically audited by the Asset and Liability Committee and the Board of Directors. The relevant processes and outcomes are also subject to internal audit, independent external audit, and public audit.