Ziraat Katılım uses the climate risk definition and categorization made by the ISSB as a reference when assessing the nature of the impacts, probability, and magnitude of risks.

The heat map study aims to identify priority sectors based on climate risk exposure and portfolio size for scenario analyses and stress tests.

Climate risk is identified as material within the Bank’s Internal Capital Adequacy Assessment Process (ICAAP) and is assessed under the scope of the second pillar capital evaluation. The activities carried out in this context consist of identifying, assessing, measuring, monitoring, and reporting the potential risks that the Bank may be exposed to due to its operations. Principles and procedures for the management of the relevant risk are regulated and relevant road maps are established. The reference point in this process is the triple line of defense set by the Bank. The majority of the Bank’s exposure to climate risk arises from customers in the commercial loan portfolio.

Climate Risk Heat Map

The heat map is one of the key tools used to identify, prioritize, and monitor climate-related risks. The climate risk heat map is a visual tool created based on the exposure levels of the sectors in the Bank’s portfolio to climate change risk and the shares of these sectors in the portfolio. The main objective of the heat map study is to identify the sectors to be prioritized for scenario analyses and stress tests, taking into account climate risk exposure and portfolio size. While preparing a climate risk heat map, climate risk scoring at the level of transition risk and physical risk is combined. Using the heat map, sectors are classified into 5 categories based on their level of climate risk. The iron and steel industry, along with the power generation sector, are among the sectors with the highest concentration of elevated climate risk within the portfolio. Based on the prepared heat map, sectors identified as high or medium-high risk are subjected together with the companies within them to stress testing under different scenarios, using parameters derived from climate scenarios selected as appropriate for the Bank. Parameters such as customers’ sectors and fields of business, customer financials, financial information on the loan portfolio, climate scenarios, sectoral market information, emission factors, customer production-consumption information are used in stress tests.

Ziraat Katılım uses the climate risk definition and categorization made by the International Sustainability Reporting Standards (ISSB) as a reference when assessing the nature of the impacts, probability, and magnitude of risks. Accordingly, the Bank categorizes climate risk into two main risk categories: “Transition Risks” that may arise during the transition to a low carbon economy that may affect its financial position and operations, or “Physical Risks” arising from environmental impacts caused by climate change. The table containing these risks and their sub-headings is shown below.

Sağa kaydırarak tablonun devamını görebilirsiniz.

| Transition Risks | |

|

Supply Demand |

The risk of changes in the supply and demand for specific commodities, products, and services. |

|

Legal/Regulatory |

The risk factor arising from the increase in operational costs incurred in the process of adaptation to the policies and legal regulations established within the scope of combating climate change. |

|

Technology |

The risk that low-carbon technologies pose to the competitiveness and costs of firms. |

|

Reputation |

The risk of reputational damage resulting from unfavorable perceptions due to environmentally harmful activities during the transition to a low-carbon economy. |

| Physical Risks | |

|

Acute |

The risks that cause sudden/indirect damage to the organization's assets or operational disruption as a result of sudden and severe events. |

|

Chronic |

These are persistent physical risks arising from long-term climate change that occur gradually over time and can have lasting impacts. |

A heat map is created by standardizing, weighting, and scoring the data obtained according to the exposure levels of the sectors in the Bank’s portfolio to climate change risk and the shares of these sectors in the portfolio. Analyses are conducted on the basis of all sectoral breakdowns of this portfolio, and these sectors are categorized into 5 different risk groups based on international standard-setting organizations and peer bank studies.

Ziraat Katılım considers climate risk as a risk factor affecting traditional risks within the scope of emerging risks.

Classification and Prioritization of Climate-related Risks by Type

In the ICAAP report, which is prepared on a solo basis in order to internally calculate the level of capital to cover the risks to which the Bank is and may be exposed and to ensure that the Bank’s activities are carried out with capital above this level, climate risk is included in the same second structural pillar together with liquidity, customer concentration, country concentration, and banking account profit share risks. The first structural pillar includes capital requirements calculated using the standardized approach for credit risk (including counterparty credit risk), market risk, and operational risks. Ziraat Katılım addresses climate risk using an emerging risks methodology and calculates an internal capital requirement for climate risk under ‘other risks’ as part of its internal capital assessment.

The Bank considers climate risk as a risk factor affecting traditional risks within the scope of emerging risks. In this context, the table below addresses the impact of transition risk and physical risk on credit, operational, and market risks, with reference to the ISSB’s definitions together with the general conjuncture and relevant examples.

The nature of the potential impacts of these risks is given in the table on the next page.

Sağa kaydırarak tablonun devamını görebilirsiniz.

| Traditional Risk | Climate Risk | Climate Risk Heading | Factors | Impacts |

|

Credit risk |

Transition risk |

Legal/Regulatory |

Regulations such as Emissions Trading System and Border Carbon Regulation |

-Impact on the income and profitability of bank customers operating in carbon-intensive sectors-Financial burden of long-term climate policies on customers |

|

Credit risk |

Transition risk |

Technology |

Increased and widespread use of low-carbon energy technologies |

Companies that are slow to transition to low-carbon technologies lose their competitive advantage and costs increase as a result of investment expenditures in new green technologies |

|

Credit risk |

Transition risk |

Supply-demand |

Changes in the supply and demand of commodities |

Increased production costs and fluctuations in commodities due to supply constraints and changing input prices |

|

Credit risk |

Physical risk |

Acute |

Heavy rains and extreme weather events |

-Loss or diminution in the financial value of collateral, which is one of the important credit risk mitigation techniques-Deterioration in customer payment performance due to disruptions in their business operations. |

|

Credit risk |

Physical risk |

Chronic |

Rising sea levels, prolonged droughts, ecosystem degradation, and habitat losses |

-Impacts on customers’ financial performance such as production interruption, loss of value chain, and increased operational costs-Risks arising from loss of value of customer tangible assets, loss of investor confidence, and increase in insurance premiums |

|

Operational Risk |

Transition risk |

Legal/Regulatory |

Greenhouse gas emissions reporting obligations |

Compliance issues and legal risks due to increased operational burden or inadequate reporting |

|

Operational Risk |

Transition risk |

Technology |

Integration of climate change-related sanctions into the Bank's system and processes |

Additional infrastructure costs and data security risk for digital transformation |

|

Operational Risk |

Physical risk |

Acute |

Heatwaves, elevated energy demand, heavy rainfall, flooding, and forest fires |

-Key properties such as offices, branches, and data centers become unusable-Interruptions in transportation and telecommunication infrastructure as a result of disasters such as floods, resulting in the loss of banks’ operational competencies |

|

Operational Risk |

Physical risk |

Chronic |

Drought, rising sea levels, heatwaves |

-Increased costs as a result of moving operations in risky geographies to safer regions-Exposure of banks’ branches and data centers in coastal areas to flooding, damaging banks’ physical assets |

Sağa kaydırarak tablonun devamını görebilirsiniz.

| Short Term | Medium Term | Long Term |

|

0-3 years |

3-10 years |

10 years and above |

The management of climate risks is integrated with Ziraat Katılım’s sustainability strategy and risk management policies and supported by analysis methods.

Management of Climate-Related Risks

The process of managing climate-related risks is carried out in an integrated manner with Ziraat Katılım’s sustainability strategy and risk management policies and is supported by various analysis methods.

Climate risk is evaluated with a holistic structure within the Bank’s risk criteria and is positioned within the prioritized traditional risks. Credit risk stands out among the related risks. In addition, climate-related risks are also included within the scope of operational risks.

Processes and internal documents related to the management of climate-related risks are developed with the principle of continuous improvement. Climate risk management is addressed in a process cycle consisting of stages such as risk identification, risk assessment, risk measurement, risk control, and monitoring and reporting risk processes. The table below shows the sectors in the Bank’s portfolio, the classes of these sectors according to the scoring made based on the climate risk methodology and the weight of these sectors in the portfolio.

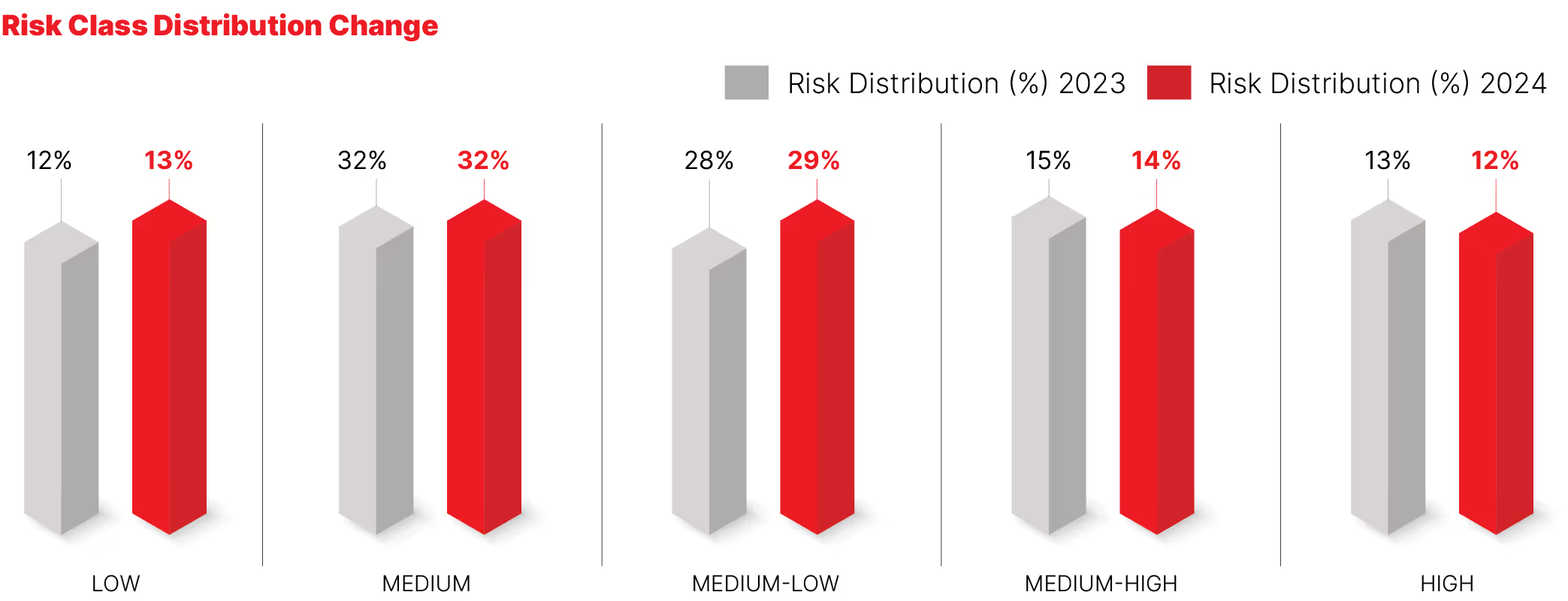

Risk Distribution Outlook of the Bank’s Loan Portfolio by Climate Risk Level

Sağa kaydırarak tablonun devamını görebilirsiniz.

| Sector | (%) 2023*** | (%)2024*** |

| High / Climate Risk Level* | ||

|

Iron-Steel |

5.63 |

3.51 |

|

Power Generation (Renewable & Non-Renewable)** |

2.37 |

2.54 |

|

Other Metals |

1.97 |

2.41 |

|

Petroleum Products |

0.84 |

0.86 |

|

Maritime Transportation |

0.51 |

0.75 |

|

Livestock Farming |

0.33 |

0.74 |

|

Aluminium |

0.82 |

0.74 |

|

Road Transportation |

0.39 |

0.50 |

|

Cement |

0.18 |

0.19 |

| Medium-High / Climate Risk Level* | ||

|

Agriculture |

4.65 |

3.24 |

|

Construction Materials |

2.59 |

2.57 |

|

Mining |

2.00 |

2.44 |

|

Automotive |

2.28 |

1.88 |

|

Other Chemical Products |

1.67 |

1.73 |

|

Basic Chemical Products |

1.19 |

1.54 |

|

Water Supply and Waste Management |

0.46 |

0.25 |

|

Other Road Transportation |

0,02 |

0.08 |

|

Air Transportation |

0.62 |

0.06 |

| Medium / Climate Risk Level* | ||

|

Textile |

10.50 |

11.01 |

|

Food |

6.57 |

7.22 |

|

Infrastructure Construction |

6.38 |

6.39 |

|

Forestry |

3.20 |

3.07 |

|

Automotive Trade |

3.11 |

2.98 |

|

Accommodation |

0.96 |

0.75 |

|

Electricity Transmission and Distribution |

0.76 |

0.40 |

|

Electricity Trading |

0.15 |

0.16 |

|

Fishery |

0.02 |

0.08 |

| Medium-low / Climate Risk Level* | ||

|

Construction |

10.93 |

14.16 |

|

Other Production |

5.31 |

4.78 |

|

Retail Trade |

4.03 |

3.86 |

|

Financial Services |

3.64 |

2.35 |

|

Trade in Chemical Products |

1.41 |

1.46 |

|

Real Estate Activities |

1.43 |

1.37 |

|

Storage |

0.28 |

0.62 |

|

Food Services |

0.27 |

0.43 |

|

Public Administration and Defense |

0.28 |

0.20 |

|

Rail Transportation |

0.02 |

0.01 |

| Low / Climate Risk Level* | ||

|

Electronic Products |

7.07 |

7.03 |

|

Administrative Services |

1.73 |

2.16 |

|

Health |

0.84 |

1.11 |

|

Professional Services |

1.06 |

0.99 |

|

Contact |

0.95 |

0.84 |

|

Education |

0.21 |

0.27 |

|

Entertainment and Art |

0.25 |

0.18 |

|

Diğer Hizmetler |

0.13 |

0.07 |

|

Other Services |

100.00 |

100.00 |

*The risk categories has been weighted towards transition risk during the scoring phase.

**The risk categories of sub-activities of the activities categorized as renewable and non-renewable differ.

***Risk weight calculation is based on cash and non-cash loans.

Climate Risk Distribution of the Top 10 Sectors in the Bank’s Portfolio

The top 10 sectors based on portfolio weight are presented in the table below and these sectors account for more than half of the portfolio with a total of 64%. As of year-end 2024, 50% of the Bank’s portfolio consists of medium and medium-low risk classes.

Sağa kaydırarak tablonun devamını görebilirsiniz.

| Climate Risk Distribution of the Top 10 Secrets in Bank's Portfolio | |||

| Sector | Climate Risk Level* | (%) 2023 | (%) 2024 |

|

Construction |

Medium-low |

10.93 |

14.16 |

|

Textile |

Medium |

10.50 |

11.01 |

|

Food |

Medium |

6.57 |

7.22 |

|

Electronic Products |

Low |

7.07 |

7.03 |

|

Infrastructure Construction |

Medium |

6.38 |

6.39 |

|

Other Production |

Medium-low |

5.31 |

4.78 |

|

Retail Trade |

Medium-low |

4.03 |

3.86 |

|

Iron-Steel |

High |

5.63 |

3.51 |

|

Agriculture |

Medium-high |

4.65 |

3.24 |

|

Forestry |

Medium |

3.20 |

3.07 |

(*) The risk categories has been weighted towards transition risk during the scoring phase.

Considering the Bank’s risk class distribution by years, there was a 1% decrease in high and medium-high risk classes as of year-end 2024 year-on-year. The Bank’s risk class distribution by years is presented in the graph below.

Monitoring Climate Related Risks

Although the Bank does not yet have an existing system enabling proactive monitoring of climate risk, project planning is underway in this regard. The actions planned by the climate risk working group include calculating bank portfolio emissions and preparing this system for the legal reporting process, which is expected to become mandatory in 2026. Moreover, work is underway to integrate climate risk criteria into the credit allocation process.