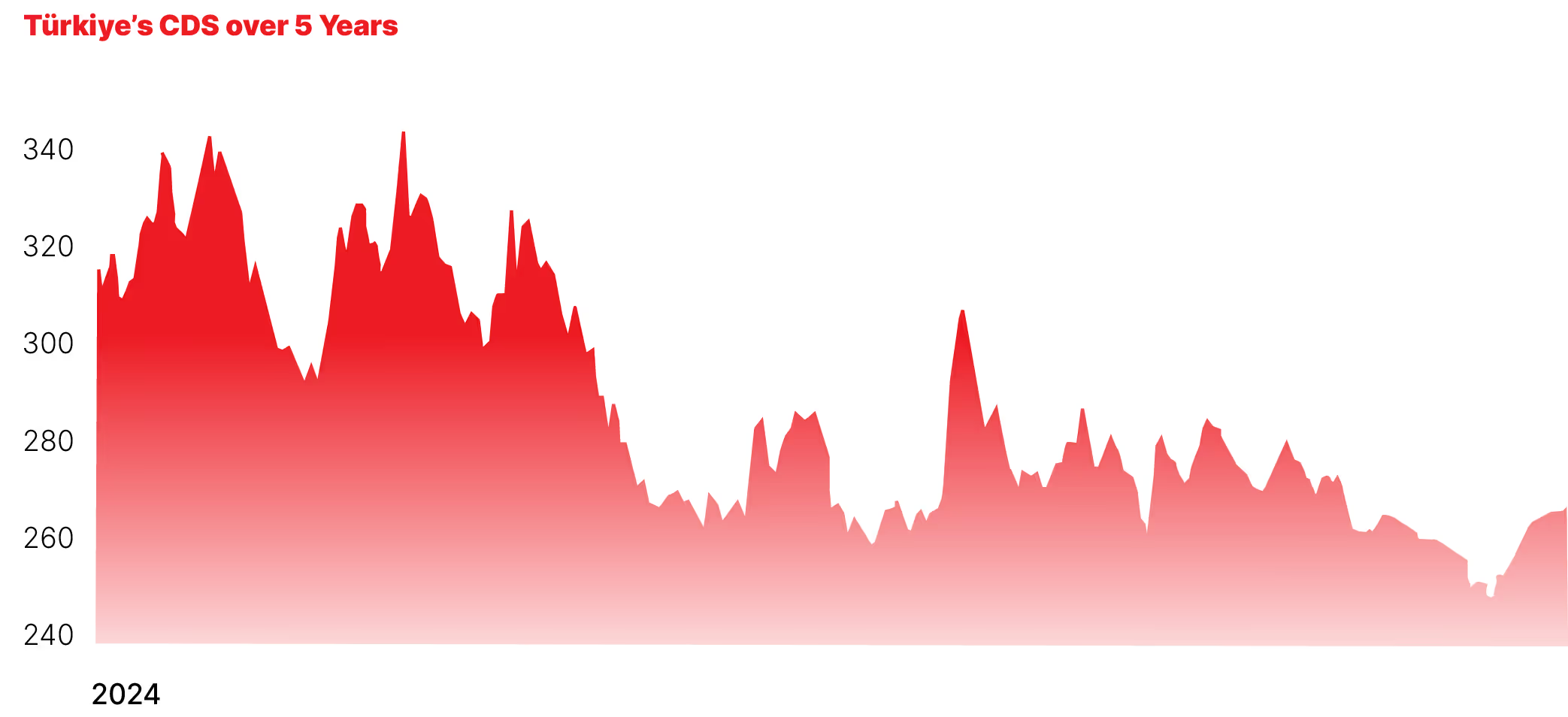

Türkiye’s credit risk premium has notably decreased, leading to lower foreign borrowing costs.

The KKM experienced a decline from a peak of TL 3.4 trillion to TL 1.12 trillion. The CBRT plans to end the KKM application in 2025.

The Economic Outlook for Türkiye

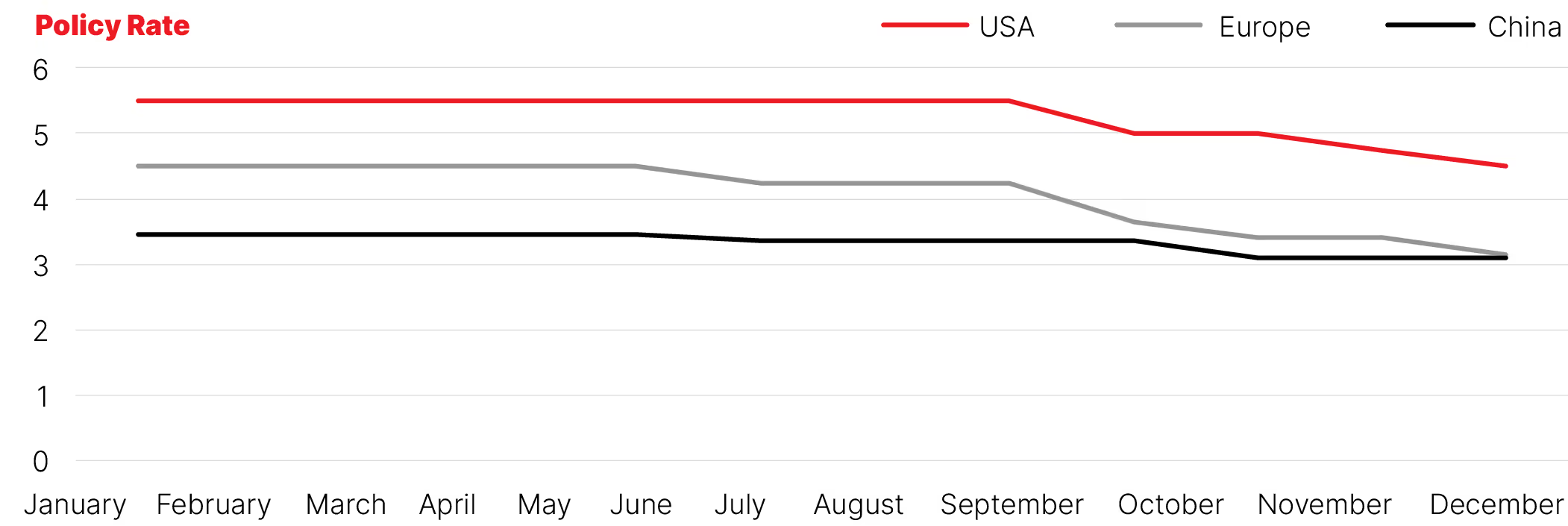

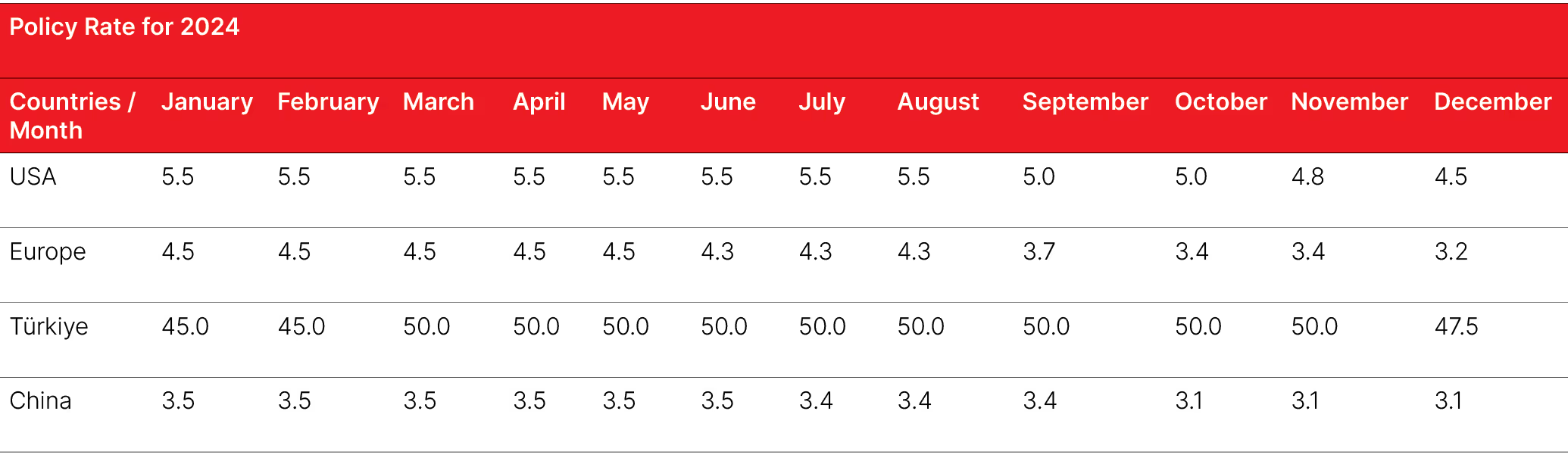

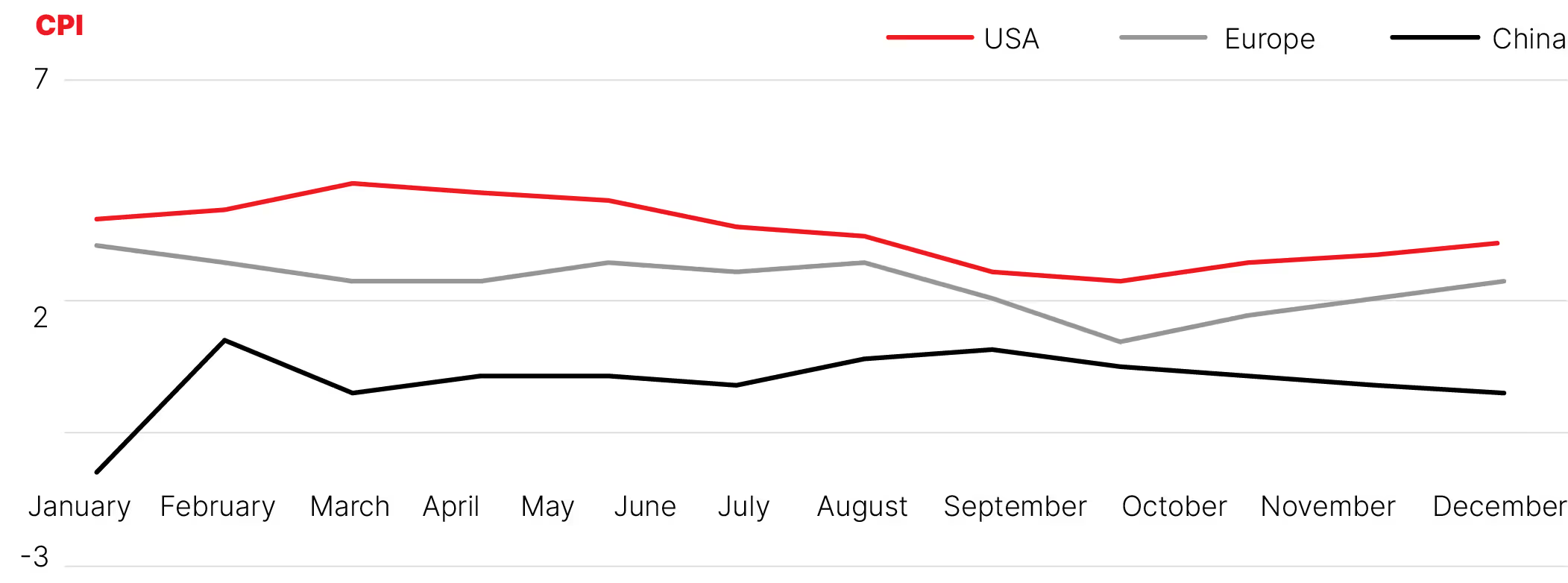

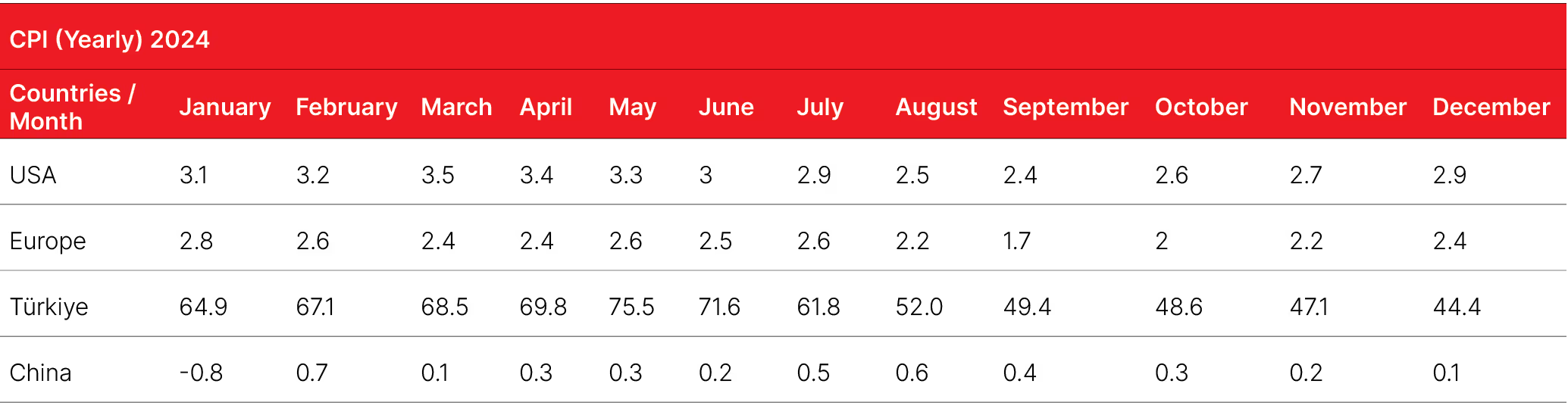

The Central Bank of the Republic of Türkiye (CBRT), which has maintained a tight monetary policy for an extended period, reduced its policy rate by 250 basis points in December, bringing it down to 47.50%. In addition to the rate cut, the CBRT narrowed the interest rate corridor from 300 basis points to 150 basis points. Along with these adjustments, the CBRT announced plans to reduce the number of meetings in 2025 from 12 to 8. The CBRT has stated that it will maintain its tight monetary policy stance until a clear and sustained decline in the core inflation trend is achieved, and inflation expectations approach the projected range.

During this period, domestic demand weakened, contributing to a continued decrease in goods inflation, while service inflation showed signs of improvement. As part of the disinflation process, interest in Turkish lira-denominated assets increased, and the balance of the protected deposit scheme (KKM) saw a significant decline. The KKM experienced a decline from a peak of TL 3.4 trillion to TL 1.12 trillion. The CBRT plans to end the KKM application in 2025. The monetary tightening supported by macroprudential measures has contributed to balancing domestic demand.

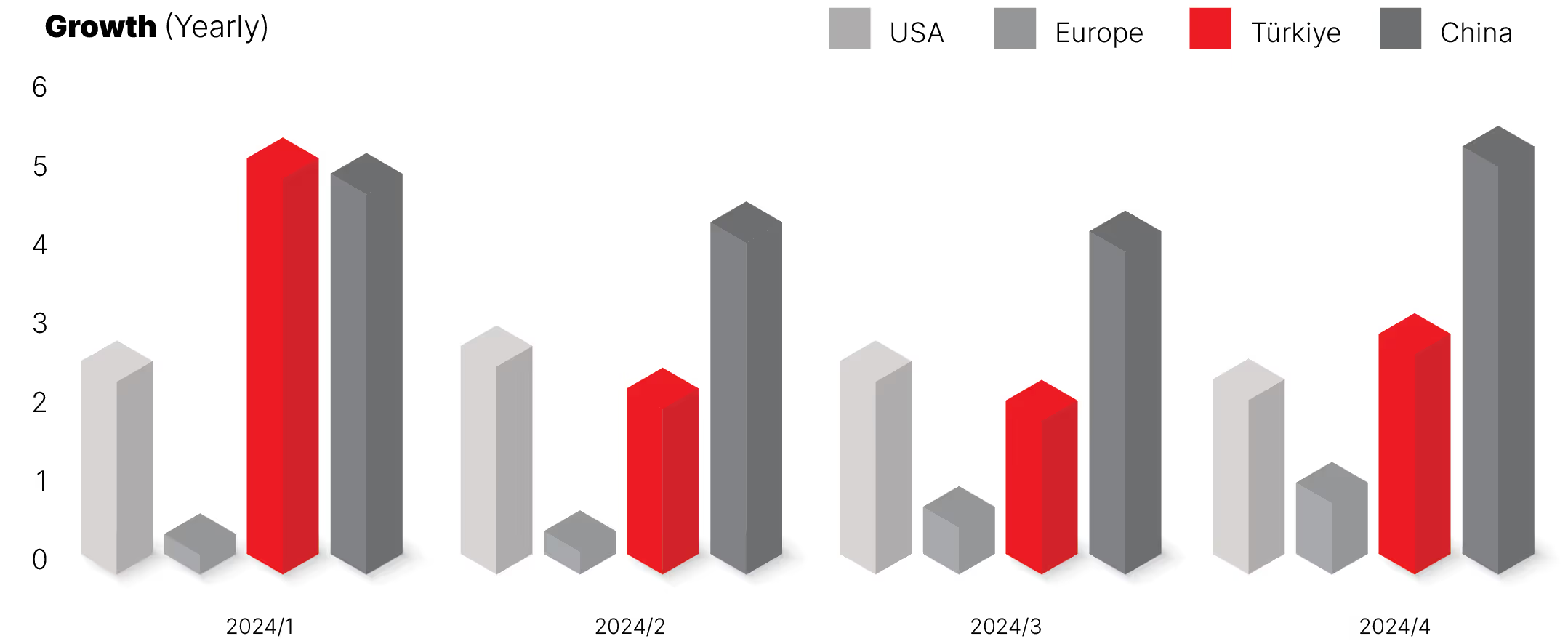

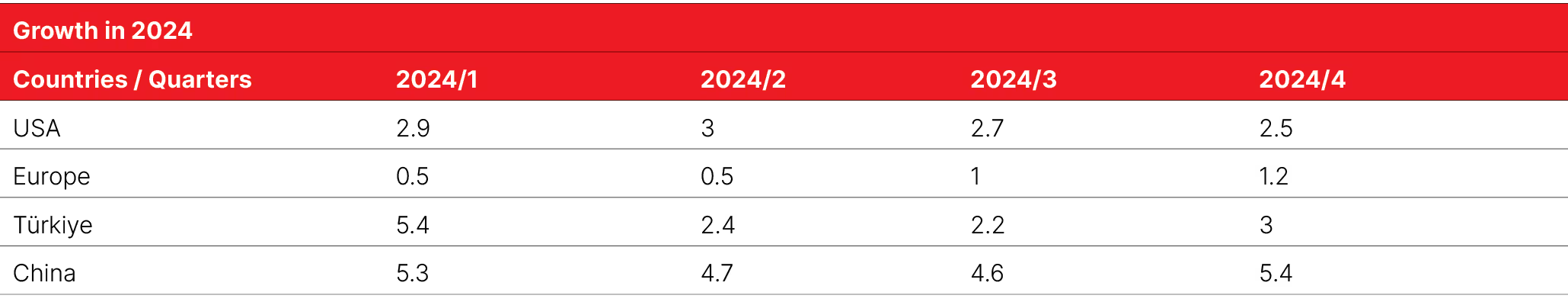

Türkiye’s credit risk premium has notably decreased, leading to lower foreign borrowing costs. Among the notable developments, Türkiye was the only country whose credit rating was upgraded by two notches by the three major credit rating agencies. According to the report published by the European Commission, the Turkish economy is projected to grow by 3% in 2024 and 3.2% in 2025, and inflation is expected to continue reducing over the forecast period.

In addition to the rate cut, the CBRT narrowed the interest rate corridor from 300 basis points to 150 basis points.